SHARE PRICE

NTA PRE-TAX

Investment performance1

DIVIDEND YIELD2

GROSSED UP YIELD3

1. Investment performance since new mandate adopted 1 July 2017.

2. Dividend yield is based on current displayed share price and dividends declared over the previous 12 months

3. Grossed up yield is based on current displayed share price, dividends declared over the previous 12 months and the tax rate and franking percentage applicable for the most recently declared dividend

INTERNATIONAL. ETHICAL. DIVIDENDS.

THE LARGEST INTERNATIONAL ETHICAL LIC ON THE ASX

Targeting fully-franked dividends. Paid Quarterly.

Pengana International Equities Limited (trading on the ASX as ‘PIA’) is a Listed Investment Company (“LIC”) that exists to provide shareholders with continued capital growth as well as regular, reliable, and fully franked dividends.

The strategy aims to generate superior risk-adjusted returns, through investing in an actively managed portfolio of global companies that meet the team’s high quality and durable growth criteria at reasonable prices. A robust responsible investment framework provides an added layer of risk mitigation.

These companies are identified through the conduct of fundamental research, with a long-term, global perspective, and must exhibit the following four key investment criteria: competitive advantages, quality management, financial strength, and sustainable growth potential.

Harding Loevner was appointed the investment manager on 10th May 2021. Harding Loevner is a New Jersey-based global equity fund manager formed in 1989 with over US$84billion in Assets under Management.

Benefits of investing in PIA’s LIC structure

- Shares can be bought and sold on the ASX

- Quarterly-annual fully franked dividends

- Investment activities are not affected by redemptions or unexpected cash inflows or outflows

- Regular reporting to shareholders e.g. semi-annual financial reports and weekly NTA

- Shareholders can interact with directors and management

- The company is subject to ASX and ASIC supervision

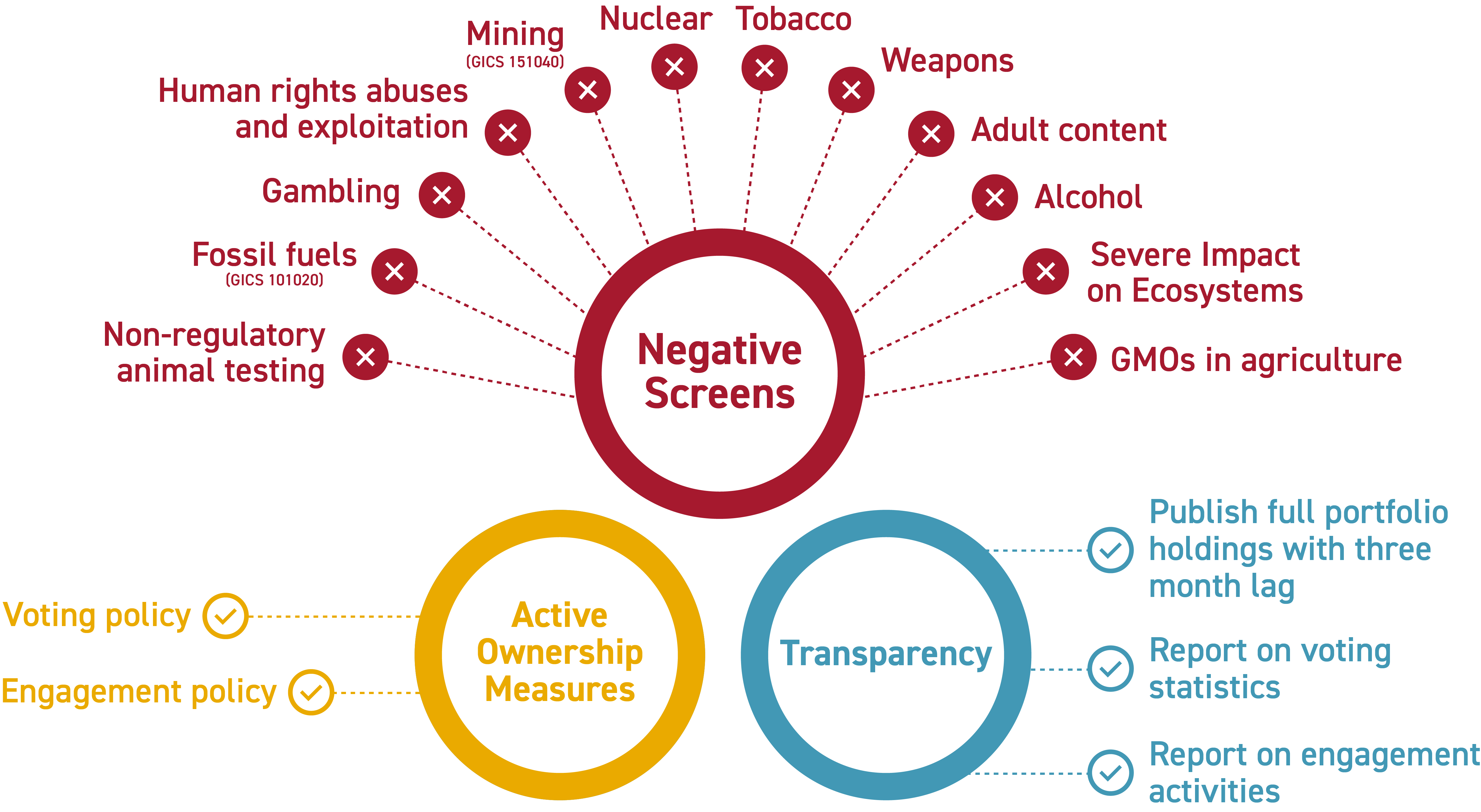

The portfolio utilises a negative screening process which seeks to avoid investment in companies that derive operating revenues from direct and material business involvement* in the following:

*Material business involvement is generally considered to be over 5% of production of, or 15% aggregate revenue from, the production, distribution and retail of the screened product/service. For thresholds on each specific screen please refer to the Responsible Investment Policy HERE

OUR INVESTMENT PHILOSOPHY

Investing in high-quality, ethically screened, growing businesses at reasonable prices leads to superior risk-adjusted returns over the long term.

This “quality-growth” investment philosophy has been the foundation of Harding Loevner’s strategies since the firm was founded in 1989. Read more >>

The philosophy is expressed in the four key criteria that a company must meet before we will consider it for investment:

Competitive Advantage

Sustainable return on capital above cost of capital within a supportive industry structure enabling it to earn better financial returns than rivals.

Sustainable Growth

An industry structure supporting long-term growth in revenues, earnings, and cash-flow.

Growth underpinned by long-term fundamental trends, not ephemeral factors.

Financial Strength

Balance sheet strength and free cash flow generation to fund long-term growth in all environments.

Quality Management

Skilful management with a good record, a clear strategy, and a consistent regard for shareholders.

PERFORMANCE

- CHART

- TABLE

July 2017 represented the first full month of Pengana International Equities Limited being mandated to Pengana for management of the investment portfolio. The performance in the table above refers to the movement in net assets per share.

Performance figures refer to the movement in net assets per share, reversing out the impact of option exercises and payments of dividends, before tax paid or accrued on realised and unrealised gains. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

None of Pengana International Equities Limited (‘PIA’), Pengana Investment Management Limited nor any of their related entities guarantees the repayment of capital or any particular rate of return from PIA. This information has been prepared by PIA and does not take into account a reader’s investment objectives, particular needs or financial situation. It is general information only and should not be considered investment advice and should not be relied on as an investment recommendation. The figures are unaudited.

Source: PCG and Bloomberg.

Pengana International Equities Limited

PERFORMANCE AT 28 Mar 2024

| 1M | 1Y | 3Y | Pengana SI July 20171 |

|

|---|---|---|---|---|

| (ASX: PIA) | 0.4% | 25.7% | 5.1% | 9.3% |

| Index2 | 3% | 28.4% | 14.3% | 13.6% |

Swipe horizontally to see all columns

* Performance for periods greater than 12 months are annualised. Performance figures refer to the movement in net assets per share, reversing out the impact of option exercises and payments of dividends, before tax paid or accrued on realised and unrealised gains. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

1. Pengana inception as the Investment Manager July 2017

2. MSCI World Total Return Index in AUD.

PORTFOLIO

Total portfolio holdings as at 28 Mar 2024: 58

- TOP HOLDINGS (alphabetically)

- Portfolio breakdown

Key Facts

ASX CODE:

PIA

RECOMMENDED TIMEFRAME:

5 years or more

TYPICAL NUMBER OF STOCKS:

35-75

MANDATED:

1 July 2017

PIA Inception: 19 March 2004

Current Strategy Inception: 30 November 1989

DIVIDEND FREQUENCY:

QUARTERLY

BENCHMARK:

MSCI World Total Return Index (net) in $A

MANAGEMENT FEE:*

1.23% p.a.

PERFORMANCE FEE:*

15.38% of any return greater than the Benchmark

*Fees are stated inclusive of GST and net of RITC. For more information, refer to the Fund’s product disclosure statement available under the Reports & Resources section.

PLATFORM AVAILABILITY

- Colonial First Wrap

- HUB24 – IDPS

- IOOF Core

- IOOF Pursuit

- Mason Stevens

- MLC Wrap/Navigator -IDPS

- Macquarie Wrap – Super/Pension

- Powerwrap

REPORTS AND RESOURCES

- Monthly Reports

- Responsible Investment

- Portfolio Holdings

- March 2024 - March Report

- February 2024 - Global share markets continued to perform

- January 2024 - Global share markets continued to make gains

- December 2023 - Global share markets continued to perform strongly

- November 2023 - November Report

- October 2023 - October Report

- September 2023 - September Report

- August 2023 - August Report

- July 2023 - Global share markets strengthened

- June 2023 - June Report & Dividend Announcement

- May 2023 - May Report

- April 2023 - April Report

- March 2023 - March Report

- February 2023 - February report

- January 2023 - Global share markets strengthen

- December 2022 - December report

- November 2022 - Signs that inflationary pressures may be starting to ease

- October 2022 - October Report

Portfolio holdings as at 30/11/2023

- AbbVie Inc

- Accenture PLC

- Adobe Inc

- Adyen NV

- AIA Group Ltd

- Alcon Inc

- Alphabet Inc

- Amazon.com Inc

- AMETEK Inc

- Apple Inc

- Applied Materials Inc

- ASML Holding NV

- Atlas Copco AB

- B3 SA - Brasil Bolsa Balcao

- Bank Central Asia Tbk PT

- Broadcom Inc

- Chugai Pharmaceutical Co Ltd

- CME Group Inc

- CoStar Group Inc

- Costco Wholesale Corp

- Danaher Corp

- Deere & Co

- Diploma PLC

- Edwards Lifesciences Corp

- Epiroc AB

- Genmab A/S

- Haleon PLC

- HDFC Bank Ltd

- Intuitive Surgical Inc

- Kering SA

- Keyence Corp

- L'Oreal SA

- Meta Platforms Inc

- Microsoft Corp

- MISUMI Group Inc

- Netflix Inc

- NIKE Inc

- NVIDIA Corp

- Pinterest Inc

- Repligen Corp

- Roche Holding AG

- Rockwell Automation Inc

- Salesforce Inc

- SAP SE

- Schneider Electric SE

- Scout24 SE

- ServiceNow Inc

- SGS SA

- Sony Group Corp

- Spirax-Sarco Engineering PLC

- Symrise AG

- Synopsys Inc

- Taiwan Semiconductor Manufactu

- Tencent Holdings Ltd

- Thermo Fisher Scientific Inc

- Tradeweb Markets Inc

- UnitedHealth Group Inc

- Veralto Corp

- Vertex Pharmaceuticals Inc

- WuXi AppTec Co Ltd

NEWS AND INSIGHTS

- Pengana International Equities Limited

- Global Small Companies Fund

- Axiom International Fund

- Harding Loevner International Fund

- Press Release

Ten reasons why 2024 could be a good year for global equity investors

Global share markets performed strongly in 2023 as inflation fell and the economy remained strong, despite higher interest rates. There...

PIA announces 14th consecutive fully-franked quarterly dividend

Australia's largest international ethical listed investment company continues to deliver on mandated fully franked quarterly dividends to shareholders. Pengana International...